Net Zero Circular Economy

Overview

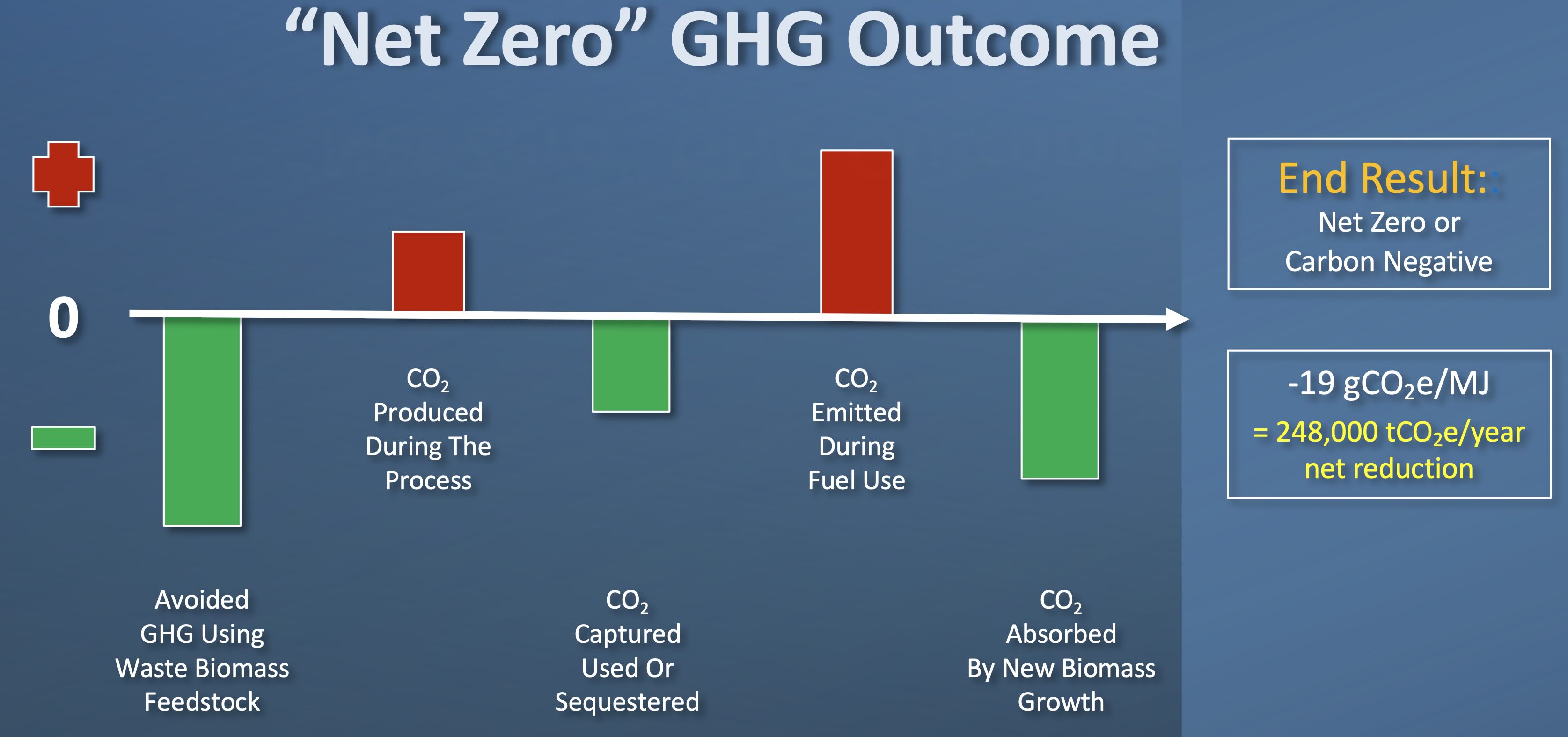

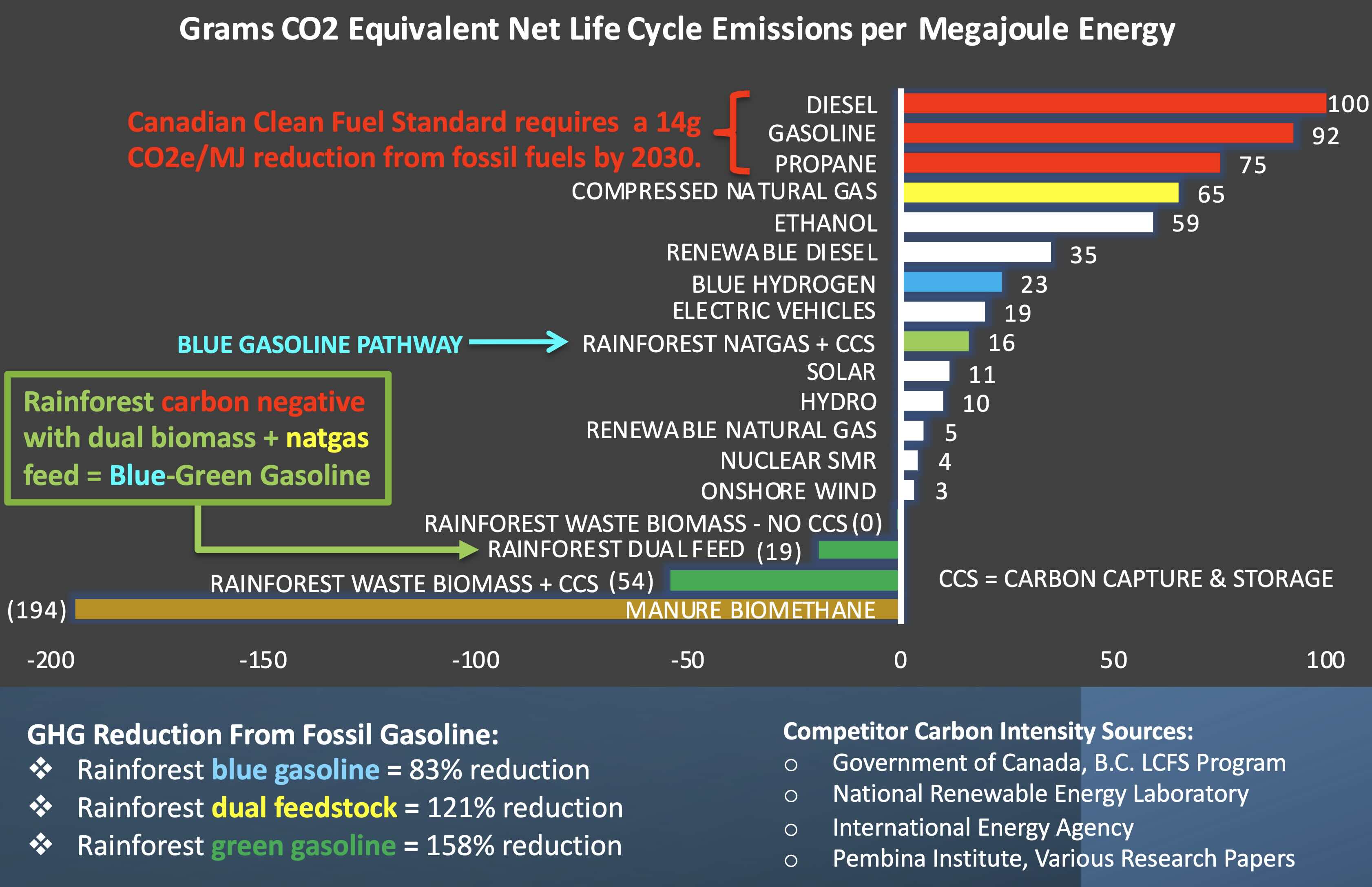

Conventional greentech such as wind, solar, and electric vehicles reduce GHG emissions but still have a positive carbon intensity on a full life cycle basis. Carbon negative solutions must therefore be included to achieve an overall net zero GHG outcome. The negative-GHG fuel to be produced by Rainforest Energy Corp. ("RFEC") from waste biomass and methane is a proven alternative that also comes at an affordable price. A Net Zero outcome does not have to sacrifice prosperity.

Abundant waste biomass exists from agriculture, forestry, and municipal waste, the decay or burning of which contribute significantly to GHG emissions. The barriers to full use of this non-food resource are supply cost and air emissions from incineration. RFEC has solved these challenges, thereby unlocking the large scale-up potential for a +$10 billion new industry.

The main product of RFEC is low-GHG, high octane gasoline. An LOI has been signed with a super-major who wishes to buy RFEC’s gasoline production from all projects. In addition to helping the customer achieve its own Net Zero target, RFEC’s fuel saves them money compared to blending ethanol with gasoline. Canada is a net at-risk importer of 3.2 billion litres (850 million USG) of ethanol and gasoline annually, the displacement of which could support over 40 RFEC facilities.

In the event that gasoline demand reduces over time, RFEC can still grow its market share as its product, unlike ethanol, has no blend limit. RFEC also has the option to reconfigure its process to produce blue hydrogen to service the electric fuel cell market, which is anticipated to benefit from the rare earth limitations of battery-electric vehicles. Alternatively, the RFEC facility could be reconfigured to produce low-GHG electricity. Gasoline currently offers the best market.

What makes RFEC different is a dedication to creating a circular economy to benefit Indigenous and rural communities, close to feedstock, and where long-term jobs are needed the most. In addition to biomass collection, local businesses can benefit from RFEC’s co-products of captured carbon dioxide, clean water, residual heat, and surplus power such as a community greenhouse, fish farm, and other agri-ventures, as well as commercial CO2 and LPG bottling and distribution.

Project Developer

The Rainforest Energy team collectively has managed over $10 billion of energy assets, which have included complex processes in the petroleum and renewable sectors. The most valuable asset that Rainforest Energy has to offer is a unique experience and track record in strategically developing and managing numerous energy projects. A flexible approach to formulating solutions allows Rainforest Energy to address the unique feedstock and market offtake characteristics of each project. We customize each project structure to engage the local situation for community inclusion and Indigenous partnerships as well as project financing requirements.

Renewable Fuel Technology

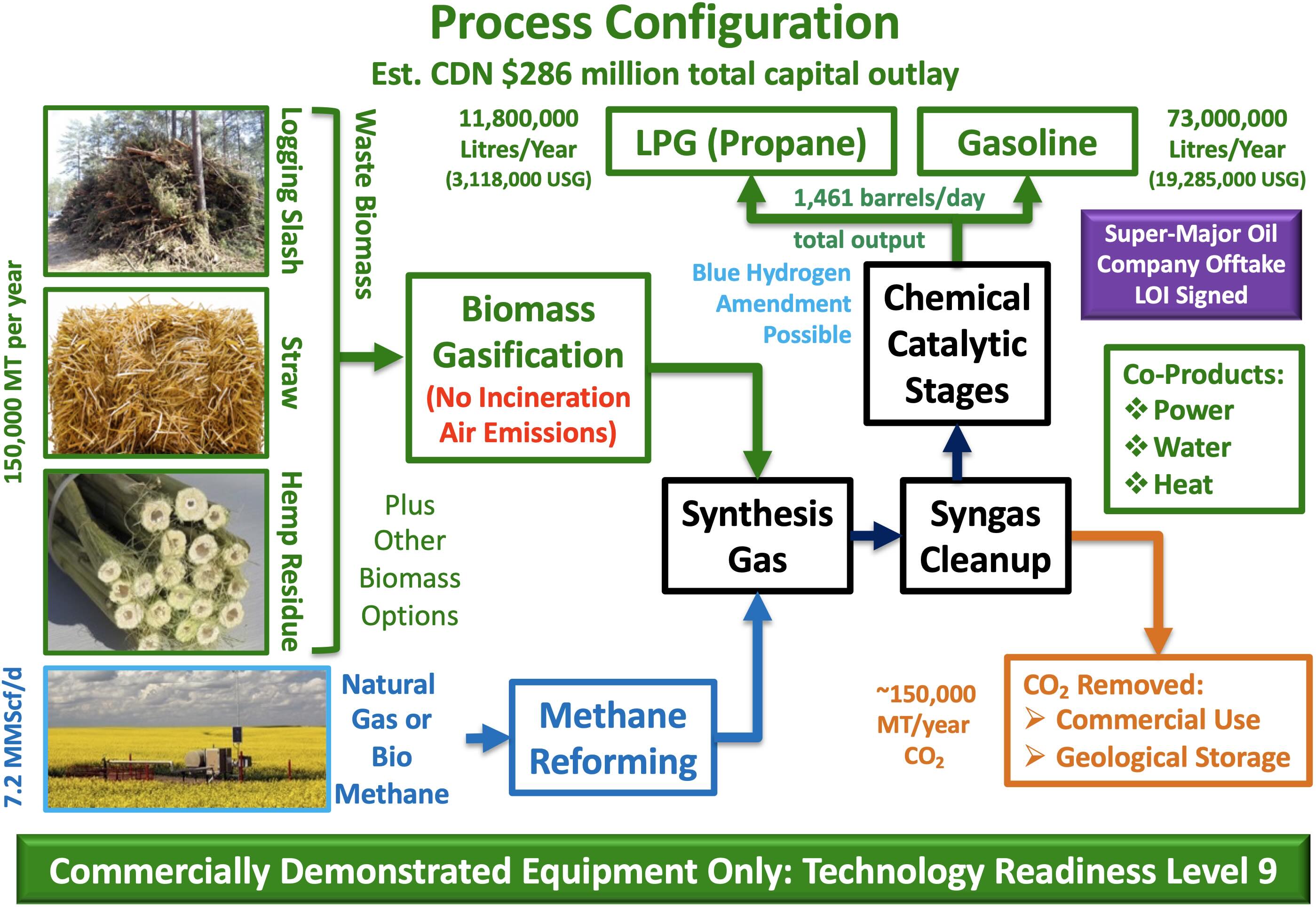

Rainforest Energy has established relationships with technology providers that can produce quality renewable gasoline and other fuels from various non-food, waste biomass such as waste wood and agricultural residue and the cellulosic component of municipal solid waste. These process designs can also accept supplemental hydrogen from methane feedstock in a parallel track within the same facility configuration. In addition to fossil natural gas, which is a recognized greenhouse gas transition fuel, methane can consist of landfill gas, renewable natural gas from waste biomass, and manure methanization for significant carbon output reductions. The advantage of accepting methane is the improvement of the carbon-hydrogen molecular balance from the combined feedstock supply, which will result in a more efficient gasoline output. This dual configuration approach also creates feedstock flexibility and mitigates input supply risk.

After sizing and partially dehydrating, biomass feedstock is first gasified in a closed chamber with oxygen control. This process avoids the air emissions normally associated with incineration, which is growing issue for biomass-based electricity production. The biomass material is transformed into synthesis gas ("syngas"), which typically consists of carbon monoxide ("CO"), hydrogen ("H2"), carbon dioxide ("CO2") and, to some extent, nitrogen ("N") and contaminants such as tars and chlorine. CO2 is removed from the syngas using an "off-the-shelf" chemical process that is commonly used in the petroleum industry. Given its high purity, it can be used for industrial purposes such as greenhouse production enhancement. There are several options for biomass gasification equipment which come with a performance history and warranties from reliable manufacturers.

Although there is syngas cleaning typically provided in the biomass gasification package, there are additional equipment providers for tar removal, wet scrubbing, and trace metals removal for additional syngas clean-up. Again, these items are available from reputable equipment providers with performance warranties. The Rainforest Energy team has narrowed down the selection of three gasification technology providers who each offer commercially demonstrated solutions to producing clean syngas.

Methane reforming is a proven technology that has reliable performance history from reputable equipment suppliers. Fossil natural gas requires no preparation as it must have passed the specifications of the pipeline transportation network from which it is delivered. Bio-methane, however, may need to remove hydrogen sulfide ("H2S") and water which utilizes "off-the-shelf" equipment. As in biomass gasification, the end result of methane reforming is a syngas product.

One of the early facilities to produce gasoline from syngas is the New Zealand gas-to-liquids ("GTL") facility constructed in 1985 by ExxonMobil. Natural gas was the feedstock. The process involved three catalytic stages: (1) syngas to methanol, (2) methanol to dimethyl ether ("DME"), and (3) DME to gasoline. It is commonly referred to as the methanol-to-gasoline ("MTG") process. The New Zealand facility operated for 12 years until the feedstock and offtake prices changed such that the economics were rendered unfeasible. It was thereafter operated at a methanol facility. During its first seven years of operation, this facility achieved an impressive 96% onstream time. The second-generation ExxonMobil GTL facility was built in China in 2009 to process syngas generated from off-spec coal. Expanded in 2011, this facility continues to operate.

Since 1985, there have been several GTL technologies deployed in various locations around the World using a variety of feedstocks. New developments in chemical-catalytic reactions have reduced the three catalytic stages in the MTG process to two. This allows for cost reductions for improved economic performance, which is an important success factor during today’s lower energy commodity prices.

Strategic Purpose

Viable new technologies are required to enable a desired transition from a fossil fuel economy. The fundamental test of such viability is economic: it must make money without life-of-project, government subsidies. Renewable fuels have become an important part of the alternative energy portfolio. However, only a very few are economic during low crude oil prices. The technology platforms available to Rainforest can generate acceptable economics at a lower oil price than its competitors with an unlevered 10% IRRBT possible at below USD $55/barrel for West Texas Intermediate. Renewable gasoline is also a more sustainable biofuel, as it offers all of the benefits of ethanol without its inherent problems of blend limitations, poor fuel economy, and engine wear.

North America is at a crossroads in its hydrocarbon future, particularly with the growing access restrictions for landlocked crude oil supply. Rainforest Energy is an opportunity to manifest some much-needed energy diversification, using the strengths that are already present locally: deep energy expertise, abundant biomass resources, mature fuel infrastructure, and established fuel marketing channels.